Bad financial habits can be hard to break, especially when they feel like part of everyday life. Most people don’t realize how much of their hard-earned money is slipping through their fingers because they’ve been doing things the same way for years.

Here are some of the most expensive habits that many Americans just can’t seem to shake.

Buying Coffee Every Day

It’s a morning routine for millions of people, but stopping at the coffee shop each day adds up fast. A simple cup might not seem like a big deal, but when you’re spending $4 to $6 on a daily caffeine fix, it can total over $1,000 a year. Making coffee at home costs just cents per cup and can be customized exactly to your liking. It may take an extra five minutes, but the savings are worth it.

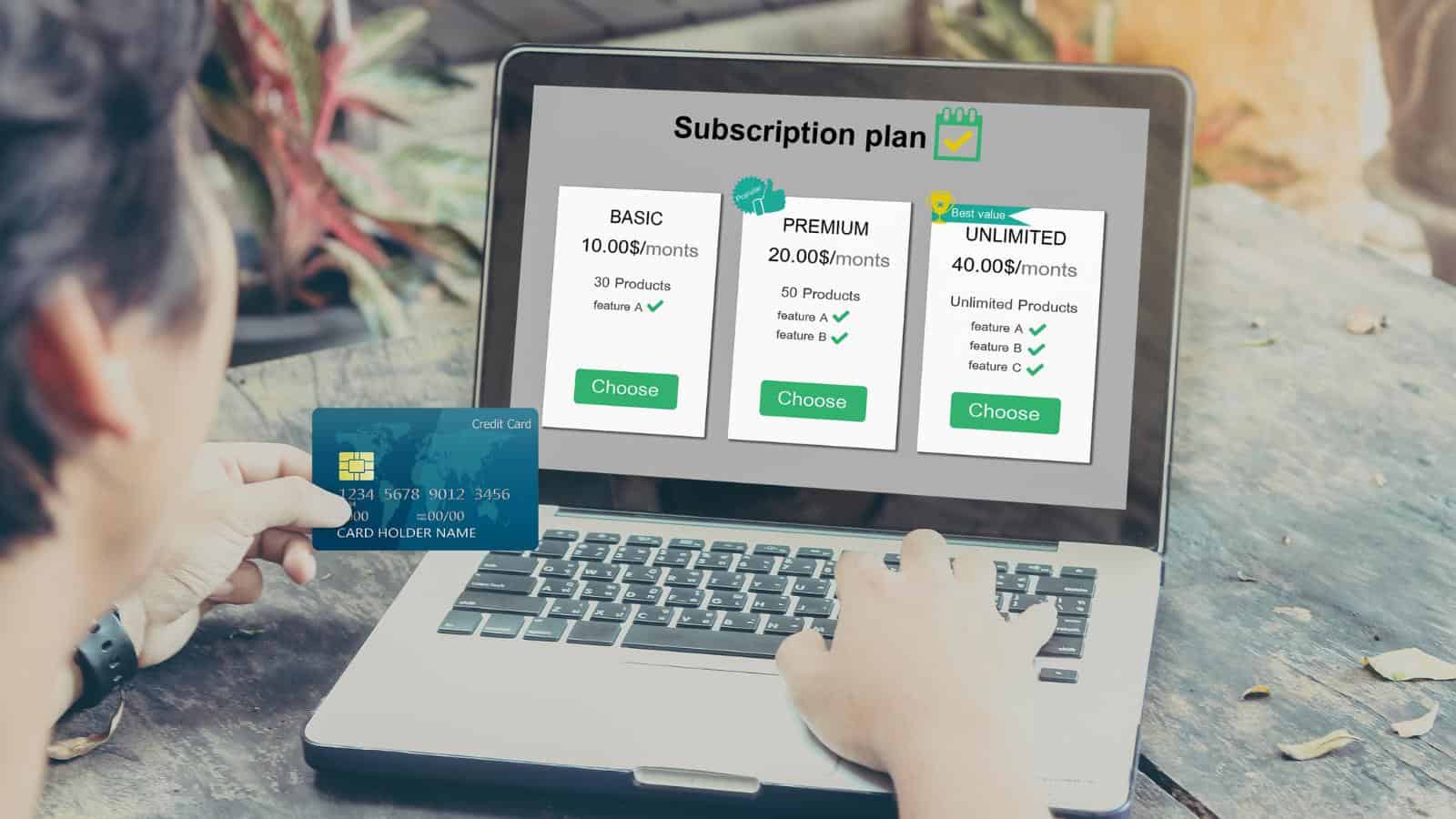

Subscribing to Too Many Streaming Services

Entertainment has never been more accessible, but the cost of keeping up with every new show can be ridiculous. People sign up for multiple streaming platforms, thinking they’ll watch everything, only to realize they’re barely using half of them. Many forget to cancel subscriptions they no longer use, letting them drain their bank accounts every month.

Instead of paying for five or six services, choose one or two at a time and rotate them throughout the year to save hundreds.

Ignoring Grocery Store Sales and Coupons

Most supermarkets have weekly sales, but a surprising number of shoppers ignore them. It’s easier to just grab what you need without checking for discounts, but that laziness costs money. Clipping coupons or using digital savings apps can knock a significant amount off each bill. A little extra effort before heading out can lead to major savings over time.

Dining Out Too Often

A meal at a restaurant is a nice treat, but making it a habit is a fast way to burn through cash. Even fast food isn’t cheap anymore, with combo meals reaching $10 or more. A sit-down dinner will cost four or five times what it would to cook at home.

Cooking may take more effort, but meal prepping for the week makes it easier and keeps costs down.

Keeping Cable TV

With countless streaming services available, paying for an expensive cable package doesn’t make much sense. Many people keep cable out of habit, even though they rarely watch most of the channels.

Ditching cable can save well over $1,000 a year, and streaming alternatives provide just as much content without the hefty price tag. Switching to an internet-based option with fewer add-ons is a smart move.

Buying Brand-Name Everything

Brand loyalty comes at a cost, and usually, it’s not worth it. Many generic or store-brand products are just as good as name-brand ones, but people pay extra just for the label. This is especially true for groceries, household products, and medication. A simple switch to generic pain relievers, cleaning supplies, or pantry staples will make a big difference in monthly expenses.

Using Credit Cards Carelessly

Plastic can be convenient, but when used irresponsibly, credit cards become a financial nightmare. High interest rates mean that carrying a balance from month to month leads to paying far more than what was originally charged. Many Americans swipe without thinking, assuming they’ll pay it off later, only to end up buried in debt.

Paying for Gym Memberships Without Going

At the start of every year, gym memberships spike as people make fitness resolutions. But enthusiasm wanes after a month or two, and many stop going, yet the payments continue. Gym contracts often make it difficult to cancel, so the money keeps disappearing even if the facility is never used.

Buying Bottled Water

A bottle of water might only cost a dollar or two, but over time, that adds up to hundreds per year. It’s a small expense that adds up in a big way. Investing in a reusable bottle and a water filter is a one-time expense that eliminates the need for constant purchases.

Tap water in most areas is perfectly safe, and filtering it at home makes it just as good as anything from a store. The environmental benefits are also a bonus.

Keeping Unused Subscriptions and Memberships

So many services today operate on a subscription model, and people often forget about the ones they no longer use. Magazines, mobile apps, delivery services, and even forgotten gym memberships quietly withdraw money from accounts each month. Checking bank statements regularly and canceling anything that isn’t being used saves a surprising amount of money.

Buying Lottery Tickets

Purchasing lottery tickets seems like harmless fun, but they’re a financial black hole. Most people never win anything substantial, yet they continue buying tickets week after week. The odds are stacked against you, and over time, that money could have been put to much better use.

If you spend $10 a week on lottery tickets, that’s over $500 a year down the drain.

Paying for Extended Warranties

Stores push extended warranties as a way to give you peace of mind, but they’re often unnecessary. Many products already come with a manufacturer’s guarantee that covers defects, and most extended warranties go unused.

Sometimes, the cost of the warranty is close to the price of replacing the item. If you’re buying a reliable brand, it’s usually better to skip the extra cost. Instead, set aside a small emergency fund for repairs or replacements.

Keeping an Unused Landline

The rise of cell phones means traditional landlines have become obsolete for many people. Yet, some still pay for a service they rarely use. Many phone companies bundle landlines with internet or cable packages, but dropping a landline can save anywhere from $20 to $50 a month.

Letting Food Go to Waste

Food waste is a huge money drain. The average household throws out hundreds of dollars’ worth of food each year. Buying more groceries than needed or forgetting about leftovers leads to chucking away perfectly good food.

Meal planning, proper storage, and repurposing leftovers will drastically reduce waste and save money. Keep an eye on expiration dates and only purchase what you know you’ll use.

Paying for Unused Apps and Software

Many people download apps or sign up for software subscriptions that seem useful at the moment but quickly become forgotten expenses. Whether it’s a meditation app, a photo editing tool, or a premium version of a service that rarely gets used, these charges quietly drain money every month.

Buying Too Many Clothes

To go shopping for new outfits is fun, but overfilling your closet with unnecessary purchases costs more than most realize. Many people buy clothes on impulse or to keep up with trends, only to wear them once or twice before they’re forgotten. Sales and fast fashion make it even easier to justify unnecessary spending.

Instead of constantly buying new items, prioritize quality over quantity and make mindful purchases to help save money.

Paying for Premium Gas Unnecessarily

Unless your car specifically requires premium fuel, there’s no benefit to using it. Many drivers assume that higher-priced gas means better performance, but for most vehicles, it makes no difference. Regular unleaded works just as well and costs significantly less per gallon. The few cents extra add up to hundreds of dollars a year.